Daily Insights Hub

Your go-to source for the latest news and information.

Banking on Change: Why You Should Care About Fintech Trends

Discover the game-changing fintech trends reshaping banking. Stay ahead and unlock secrets to financial success!

Understanding Fintech: Key Trends Reshaping the Banking Landscape

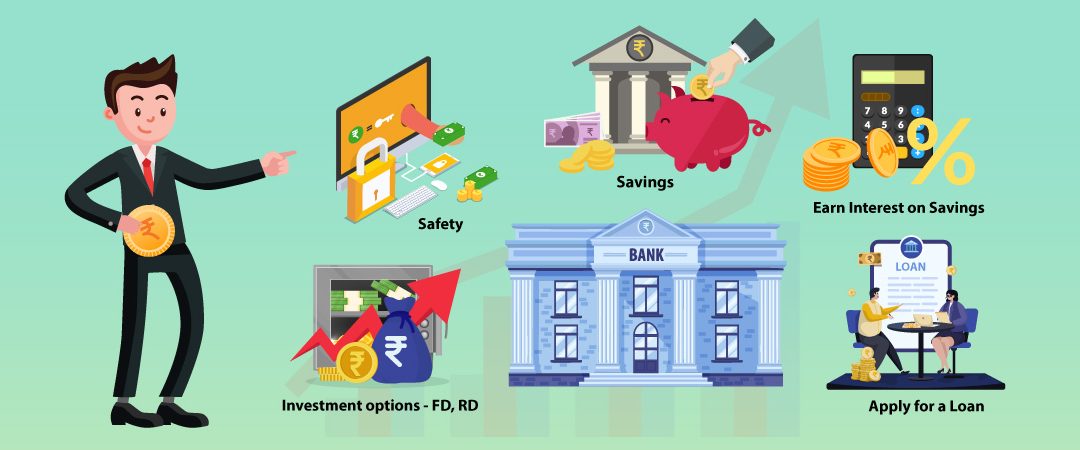

Understanding Fintech is essential as it plays a crucial role in reshaping the traditional banking landscape. Key trends include the rise of digital payment solutions, which streamline transactions and enhance customer convenience. Technologies such as blockchain and artificial intelligence (AI) are transforming how financial institutions operate, allowing for faster and more secure transactions. Furthermore, mobile banking applications are gaining traction, providing users with personalized banking experiences and easy access to their finances anytime, anywhere.

Another significant trend is the emergence of robo-advisors, which leverage AI to provide financial advice at a fraction of the cost of traditional advisors. According to a report from McKinsey & Company, the integration of these technologies is expected to revolutionize the wealth management industry. Moreover, as regulations evolve, we are witnessing an increase in collaboration between fintech companies and established banks, fostering innovation while ensuring compliance and security. Understanding these trends is vital for consumers and investors alike, as they navigate the rapidly changing financial environment.

How Fintech Innovations are Improving Financial Accessibility

In recent years, fintech innovations have played a crucial role in enhancing financial accessibility for underserved populations. By utilizing mobile technology, these solutions enable users to access banking services directly from their smartphones, thus breaking down traditional barriers posed by physical bank locations. According to a report by the World Bank, approximately 1.7 billion adults worldwide remain unbanked, with fintech emerging as a viable pathway to integrate them into the financial ecosystem.

Additionally, fintech innovations like peer-to-peer lending platforms and digital wallets are democratizing financial services by providing more affordable options compared to conventional banking systems. These advancements reduce the cost of transactions and improve efficiency, making it easier for individuals and small businesses to access credit. A study by McKinsey & Company highlights that fintech solutions not only empower users but also contribute to financial literacy, enabling customers to make informed decisions about their finances.

Is Your Bank Keeping Up? The Importance of Adapting to Fintech Trends

In today's rapidly evolving financial landscape, traditional banks face intense pressure to innovate and adapt to fintech trends. As more consumers shift towards digital solutions for banking and financial management, it becomes crucial for banks to stay relevant. The rise of mobile payment platforms, robo-advisors, and blockchain technology are just a few examples of how fintech is reshaping the industry. If your bank does not keep pace with these changes, it risks losing customers to more agile, tech-savvy competitors.

Moreover, adapting to fintech trends is not just about improving customer retention; it's also about enhancing operational efficiency. Many banks are already embracing artificial intelligence and machine learning to analyze data and provide personalized services to their clients. According to a report from PwC, over 75% of banking executives believe that technology will change the way they interact with customers. This emphasizes the point that the future of banking lies in collaboration with fintech, rather than competition. Accepting this challenge can position banks for long-term success in a digital-first world.