Daily Insights Hub

Your go-to source for the latest news and information.

Cyber Liability Insurance: Your Business's Best-Kept Secret

Unlock the hidden protection your business needs! Discover why cyber liability insurance is your best-kept secret for security and peace of mind.

Understanding Cyber Liability Insurance: What Every Business Needs to Know

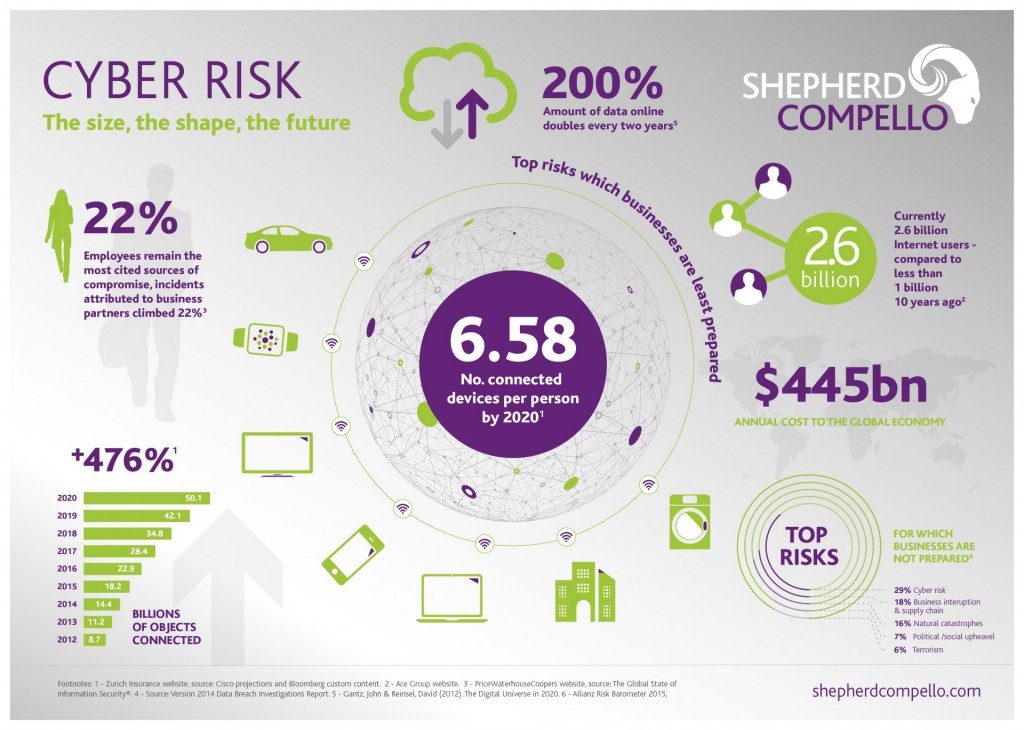

Cyber liability insurance is an essential part of risk management for businesses in today's digital landscape. As companies increasingly rely on technology to conduct operations, they become more vulnerable to data breaches and cyberattacks. This form of insurance helps protect businesses from the financial fallout associated with these incidents, such as litigation costs, regulatory fines, and the expenses related to recovering compromised data. Understanding the key features and coverage options of cyber liability insurance is crucial for every business owner.

When evaluating cyber liability insurance, consider the following key elements:

- First-party coverage protects your own business against costs incurred due to a cyber incident, including data restoration and business interruption.

- Third-party coverage safeguards you against claims made by customers or clients affected by data breaches, which may include legal fees and settlements.

- Regulatory fines and penalties coverage is crucial in industries with strict data protection laws, helping alleviate expensive fines resulting from non-compliance.

Is Your Business Protected? The Essential Guide to Cyber Liability Insurance

Cyber liability insurance is becoming increasingly essential for businesses of all sizes as the frequency and sophistication of cyberattacks continue to rise. With data breaches and ransomware attacks making headlines, it’s crucial for companies to understand the importance of protecting themselves against financial losses and reputational damage. This type of insurance typically covers expenses related to data breaches, including legal fees, notification costs, and credit monitoring for affected customers. Understanding the specific coverage options available can help determine the best policy for your unique business needs.

When evaluating your options, consider the following key elements of cyber liability insurance:

- Network security coverage: Protects against breaches caused by hacking or malware.

- Data privacy coverage: Covers damages related to unauthorized access to confidential client information.

- Business interruption coverage: Compensates for lost income if your business operations are disrupted due to a cyber incident.

Top 5 Myths About Cyber Liability Insurance Debunked

Cyber liability insurance is often surrounded by misconceptions that can lead businesses to underestimate its importance. One prevalent myth is that only large corporations need this type of coverage. In reality, cyber liability insurance is essential for businesses of all sizes. Small and medium-sized enterprises (SMEs) are increasingly becoming targets for cyberattacks, and without the proper insurance, they risk crippling financial losses.

Another common myth is that cyber liability insurance covers all types of cyber incidents automatically. However, the truth is that policies vary significantly, with some only covering specific types of breaches or data loss. It's crucial for business owners to thoroughly review their policy's terms and conditions to ensure they understand what is included. To further complicate matters, many assume that their general liability insurance will cover cyber-related incidents; this is not the case, making cyber liability insurance a vital component of a robust risk management strategy.