Daily Insights Hub

Your go-to source for the latest news and information.

Decoding the Blockchain: Unmasking Secrets with On-Chain Transaction Analysis

Unlock the mysteries of blockchain! Discover how on-chain analysis reveals hidden secrets and transforms your understanding of cryptocurrency.

Understanding On-Chain Transaction Analysis: A Beginner's Guide

Understanding On-Chain Transaction Analysis is essential for anyone looking to delve into the world of cryptocurrencies and blockchain technology. At its core, on-chain transaction analysis refers to examining the data recorded on a blockchain to identify, track, and understand transactions. This process enables users to glean insights into the behavior of various assets and their interactions within the network. As a beginner, it's vital to familiarize yourself with blockchain explorers and other analytical tools that provide visibility into on-chain data. By doing so, you can learn how to assess transaction volumes, recognize patterns, and even determine the liquidity of specific cryptocurrencies.

One of the pivotal aspects of on-chain transaction analysis is its ability to enhance transparency and trust in the cryptocurrency ecosystem. Unlike traditional financial systems, where transactions can often be opaque, blockchain technology allows for a public ledger that anyone can access. This level of openness facilitates better decision-making for investors and enhances market security. As you continue to explore this field, consider familiarizing yourself with concepts such as transaction confirmation times, fees, and the impact of network congestion on transaction efficiency. Engaging with these elements will not only deepen your understanding but also improve your overall trading strategy.

Counter-Strike is a popular tactical first-person shooter that has captivated gamers since its inception in 1999. The game features teams of terrorists and counter-terrorists battling to complete objectives or eliminate the opposing team. Players often seek out new strategies and promotions to enhance their gaming experience, such as using a bc.game promo code for in-game advantages.

How Does On-Chain Analysis Enhance Blockchain Transparency?

On-chain analysis refers to the examination of blockchain data to glean insights about transaction patterns, user behavior, and network health. This practice enhances blockchain transparency by allowing stakeholders to access and interpret public ledger information without intermediary intervention. As all transactions are recorded on a decentralized ledger, on-chain analysis provides unparalleled visibility into the flow of assets, enabling users to verify the authenticity of transactions and track the movement of funds across the network. Moreover, this transparency fosters trust among participants, as any discrepancies or illicit activities can be quickly identified and addressed.

Additionally, on-chain analysis allows for the development of sophisticated tools and algorithms that further increase blockchain transparency. These tools can aggregate and visualize data, offering insights into network performance, transaction fees, and even user demographics. By leveraging this data, developers and researchers can identify trends, improve security protocols, and enhance the overall efficiency of blockchain networks. As the demand for transparency in digital transactions rises, on-chain analysis will play a pivotal role in ensuring that blockchain technology remains a secure and trusted framework for financial services and beyond.

What Secrets Can On-Chain Data Reveal About Cryptocurrency Trends?

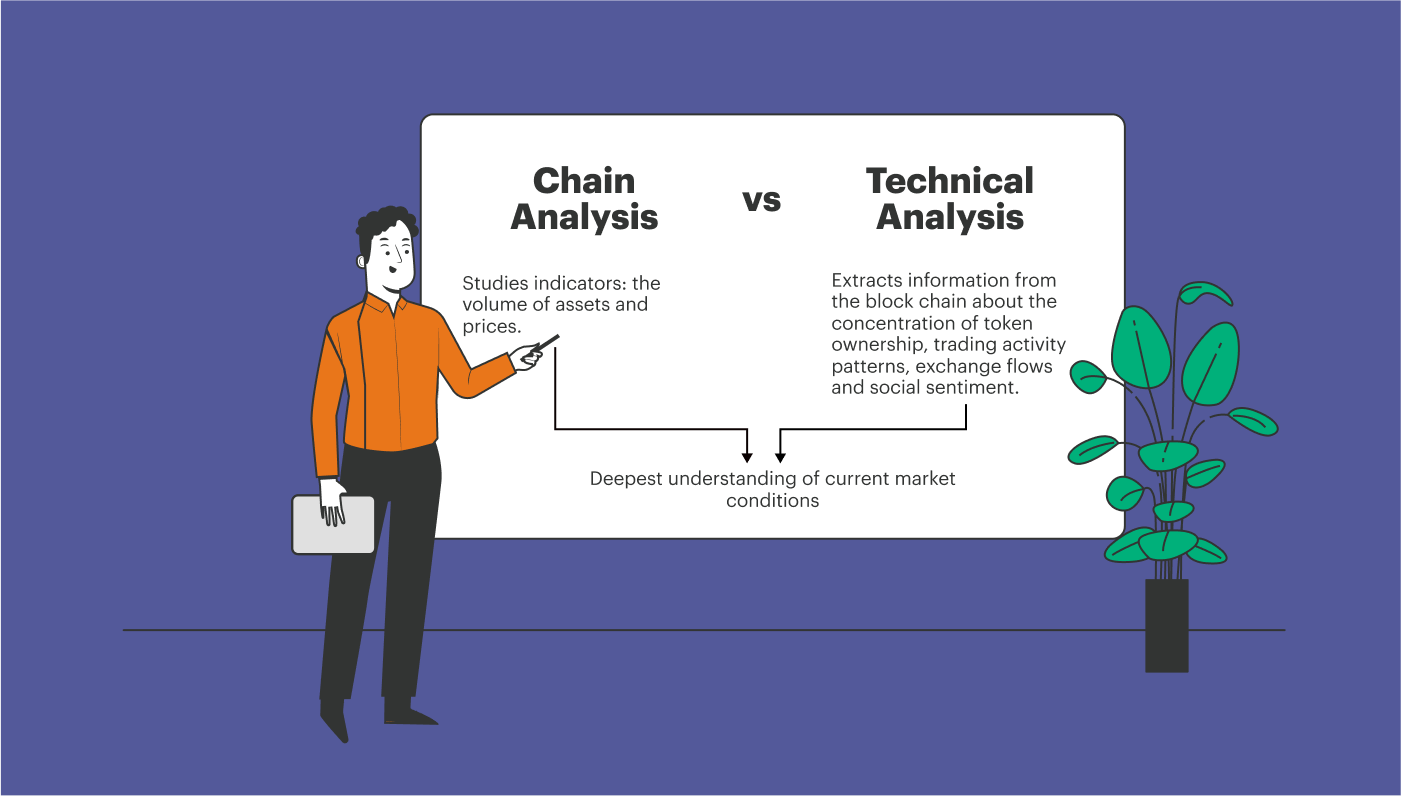

The world of cryptocurrency is dynamic, with trends shifting rapidly. One of the most significant advantages of cryptocurrencies is that they operate on blockchain technology, which is inherently transparent. By analyzing on-chain data, investors can gain invaluable insights into market behaviors and user activities. For instance, factors like transaction volume, wallet addresses, and active user counts can highlight trends such as increasing adoption or market volatility. By monitoring these metrics, it becomes possible to identify potential turning points in price movements and investor sentiment.

Furthermore, on-chain analytics can unveil hidden patterns that may not be evident through traditional market data. For example, when large amounts of cryptocurrency are transferred to exchanges, it may signal impending selling pressure as investors look to capitalize on profits. Conversely, increased holdings in private wallets could indicate confidence in the asset's long-term value. By leveraging these insights, traders can position themselves strategically in a way that aligns with emerging trends, thereby enhancing their potential for profit in the evolving cryptocurrency landscape.