Daily Insights Hub

Your go-to source for the latest news and information.

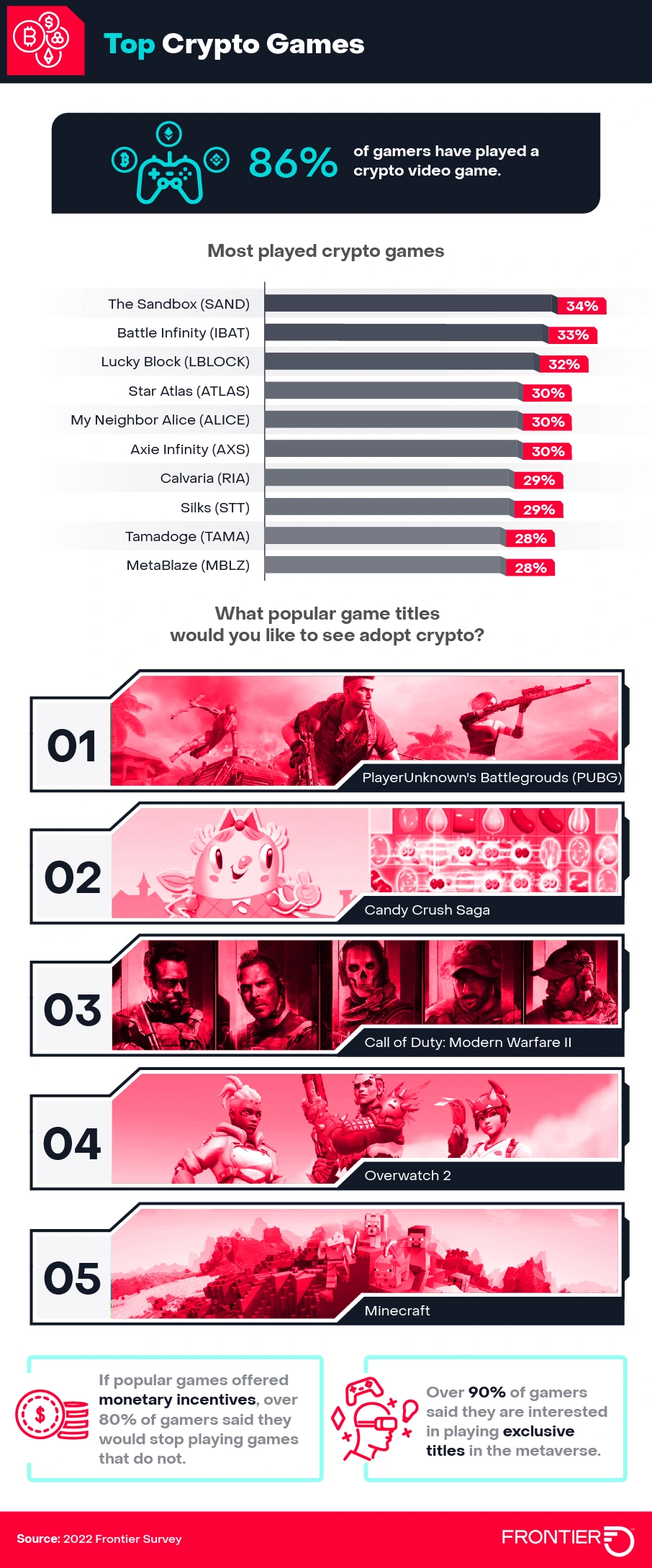

Level Up: How Cryptocurrency is Changing the Game

Discover how cryptocurrency is revolutionizing finance and tech! Uncover trends, insights, and what it means for your future. Level up with us!

Understanding Blockchain Technology: The Backbone of Cryptocurrency

Blockchain technology serves as the foundational framework that powers cryptocurrencies like Bitcoin and Ethereum. At its core, a blockchain is a distributed digital ledger that records transactions across many computers so that the registered transactions cannot be altered retroactively without the alteration of all subsequent blocks and the consensus of the network. This design not only ensures the integrity of the data but also enhances security and transparency, critical elements in the realm of digital currencies. Understanding how blockchain functions is essential for anyone looking to navigate the world of cryptocurrency, as it is the technology that enables decentralized finance and eliminates the need for intermediaries.

One of the defining characteristics of blockchain is its decentralization. Unlike traditional banking systems that rely on a central authority, blockchain operates on a peer-to-peer network where each participant can access the entire blockchain. There are several types of blockchain, including public, private, and consortium blockchains, each serving different needs. The innovation brought by blockchain technology is not limited to cryptocurrencies; it's also transforming various industries such as supply chain management, healthcare, and voting systems by providing a reliable method for tracking assets and transactions securely. Hence, having a deep understanding of blockchain technology is crucial for recognizing its potential beyond just financial applications.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based game modes. Players can enhance their gaming experience with various promotions, including the duelbits promo code for exciting rewards. The game's strategic depth and competitive nature have established it as a staple in the esports community.

How Cryptocurrency is Revolutionizing Traditional Finance

The advent of cryptocurrency is challenging the status quo of traditional finance, presenting innovative solutions to age-old problems. Blockchain technology, which underpins most cryptocurrencies, enables secure and transparent transactions, minimizing the need for intermediaries such as banks. This innovation not only reduces costs associated with cross-border transactions but also accelerates processing times, allowing for nearly instantaneous transfers. As more individuals and businesses begin to embrace this digital currency, we witness a shift towards a more decentralized financial ecosystem where users have greater control over their assets.

Furthermore, cryptocurrency is democratizing access to financial services, particularly in underserved regions of the world. With just a smartphone and internet connection, individuals can access a wide array of services, from lending to investing, without the barriers posed by traditional banking systems. This phenomenon is particularly evident in developing countries, where the lack of banking infrastructure has historically limited financial inclusion. By harnessing the power of digital currencies, we are moving towards a future where everyone has the opportunity to participate in the global economy.

Is Cryptocurrency the Future of Money? Exploring Trends and Predictions

The rise of cryptocurrency has sparked widespread debate about its potential to reshape the future of money. As traditional financial systems grapple with the challenges of digital transformation, cryptocurrencies like Bitcoin and Ethereum offer innovative solutions such as decentralization and enhanced security. Many experts believe that the increasing adoption of blockchain technology will lead to a significant shift in how transactions are conducted, with benefits such as lower fees, faster transactions, and increased access for the unbanked population. This growing trend raises critical questions about the role of digital currencies in the global economy.

Looking ahead, predictions about the future of money are heavily influenced by ongoing developments in the crypto market. For instance, a report by a leading financial institution suggests that by 2030, nearly 1 in 5 individuals could rely on some form of digital currency for everyday transactions. Additionally, as regulatory frameworks continue to evolve, mainstream acceptance of cryptocurrencies may pave the way for innovation in areas such as smart contracts and decentralized finance (DeFi). These advancements could unlock new possibilities and drive further investment in the digital currency landscape, making the question of cryptocurrency's sustainability and viability as a future payment method even more pertinent.